On August 16, the U.S. government will debut of a new type of Consumer Price Index (CPI), one which it says will better reflect true inflation. Unlike the existing CPI, the new index will be subject to revisions as more detailed data become available. The regular CPI has long been criticized for overstating the actual rate of inflation. The hope is that, once the Fed is able to use more accurate information concerning general prices, it will be in a better position to use its tools to counter inflation.

Is inflation about price rises?

The fundamental problem here is a failure to define the problem properly. For example, the definition of human action is not that people are engaged in all sorts of activities, but that they are engaged in purposeful activities-purpose gives rise to an action.

Similarly, the essence of inflation is not a general rise in prices but an increase in the supply of money, which in turns sets in motion a general increase in the prices of goods and services.

Consider the case of a fixed money supply. Whenever people increase their demand for some goods and services, money will be allocated toward other goods. Thus, the prices of some goods will increase-i.e., more money will be spent on them-while the prices of other goods will fall-i.e., less money will be spent on them.

If the demand for money increases against goods and services, there will be a general fall in prices. In order for an economy to experience a general rise in prices, there must be an increase in the money stock. With more money and no change in money demand, people can now allocate a greater amount of money for all goods and services.

From this we can conclude that inflation is a general increase in the money supply.

As Mises explained in his essay “Inflation: An Unworkable Fiscal Policy“:

“Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term `inflation’ to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. . . . As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation.”

When inflation is seen as a general rise in prices, then anything that contributes to price increases is called inflationary. It is no longer the central bank and fractional-reserve banking that are the sources of inflation, but rather various other causes. In this framework, not only does the central bank have nothing to do with inflation, but, on the contrary, the bank is regarded, against all evidence, as an inflation fighter.

Thus, a fall in unemployment or a rise in economic activity is seen as a potential inflationary trigger which therefore must be restrained by central-bank policies. Some other triggers, such as rises in commodity prices or workers wages, are also regarded as potential threats and therefore must always be under the watchful eye of the central bank.

The popular definition cannot explain why inflation is bad

If inflation is just a general rise in prices, then why is it regarded as bad news? What kind of damage does it do? Mainstream economists maintain that inflation, which they label as general price increases, causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of pensioners and low-income earners and causes a misallocation of resources.

Despite all these assertions regarding the side effects of inflation, mainstream economics doesn’t tell us how all these bad effects are caused. Why should a general rise in prices hurt some groups of people and not others? Why should a general rise in prices weaken real economic growth? Or how does inflation lead to the misallocation of resources? Moreover, if inflation is just a rise in prices, surely it is possible to offset its effects by adjusting everybody’s incomes in the economy in accordance with this general price increase.

However, if we accept that inflation is an increase in the money supply, and not a rise in prices, all these assertions can be easily explained. It is not the symptoms of a disease but rather the disease itself that causes the physical damage. Likewise, it is not a general rise in prices but increases in the money supply that inflict the physical damage on wealth generators.

Increases in the money supply set in motion an exchange of nothing for something. They divert real funding away from wealth generators toward the holders of the newly created money. This is what sets in motion the misallocation of resources, not price rises as such. Moreover, the beneficiaries of the newly created money-i.e., money “out of thin air”-are always the first recipients of money, for they can divert a greater portion of wealth to themselves. Obviously, those who either don’t receive any of the newly created money or get it last will find that what is left for them is a diminished portion of the real pool of funding.

Furthermore, real incomes fall, not because of general rises in prices, but because of increases in money supply; in other words, inflation depletes the real pool of funding, thereby undermining the production of real wealth- i.e., lowering real incomes. General increases in prices, which follow increases in money supply, only point to the erosion of money’s purchasing power-although general rises in prices by themselves do not undermine the formation of real wealth as such.

As a result of an erroneous definition of inflation, some economists argue that low inflation is a precondition for healthy economic growth. For them, inflation is bad news only when it is reaches high figures [1]. If a general rise in prices is the outcome of a rising money stock, how can it benefit the economy if it is stabilized at a low level? Surely the rising money stock that will dilute the real pool of funding cannot be good for economic growth.

Friedman’s misleading view of inflation

Some economists, such as Milton Friedman, maintain that if inflation is “expected” by producers and consumers, then it produces very little damage [2]. The problem, according to Friedman, is with unexpected inflation, which causes a misallocation of resources and weakens the economy. According to Friedman, if a general rise in prices can be stabilized by means of a fixed rate of monetary injections, people will then adjust their conduct accordingly. Consequently, Friedman says, expected general price increases, which he calls expected inflation, will be harmless, with no real effect.

Observe that, for Friedman, bad side effects are not caused by increases in the money supply but by the outcome of that: increases in prices. Friedman regards money supply as a tool that can stabilize general rises in prices and thereby promote real economic growth. According to this way of thinking, all that is required is fixing the rate of money growth, and the rest will follow suit.

However, it is overlooked by the distinguished professor that fixing the money supply’s rate of growth does not alter the fact that money supply continues to expand. This, in turn, means that it will continue the diversion of resources from wealth producers to non-wealth producers even if prices of goods will stay stable. In short, the policy of stabilizing prices is likely to generate more instability.

While increases in money supply ( i.e., inflation) are likely to be revealed in general price increases, this need not always be the case. Prices are determined by real and monetary factors. Consequently, it can occur that if the real factors are pulling things in an opposite direction to monetary factors, no visible change in prices might take place. In other words, while money growth is buoyant-i.e., inflation is high-prices might display low increases. Clearly, if we were to regard inflation as a general rise in prices, we would reach misleading conclusions regarding the state of the economy.

On this, Rothbard wrote, “The fact that general prices were more or less stable during the 1920s told most economists that there was no inflationary threat, and therefore the events of the great depression caught them completely unaware”. [3]

Why price indices cannot establish the status of inflation

Because inflation is not a general increase in prices but rather increases in the money supply, it is an exercise in futility to devise a more accurate Consumer Price Index. Moreover, despite its popularity, the whole idea of a CPI is flawed. It is based on a view that it is possible to establish an average of prices of goods and services.

Suppose two transactions are conducted. In the first transaction, one loaf of bread is exchanged for $2. In the second transaction, one liter of milk is exchanged for $1. The price, or the rate of exchange, in the first transaction is $2/one loaf of bread. The price in the second transaction is $1/one liter of milk. In order to calculate the average price, we must add these two ratios and divide them by two; however, it is conceptually meaningless to add $2/one loaf of bread to $1/one liter of milk.

It is interesting to note that in the commodity markets, prices are quoted as dollars/barrel of oil, dollars/ounce of gold, dollars/tonne of copper, etc. Obviously it wouldn’t make much sense to establish an average of these prices. Likewise, it doesn’t make much sense to establish an average of the exchange rates dollar/sterling, dollar/yen, etc.

On this Rothbard wrote, “Thus, any concept of average price level involves adding or multiplying quantities of completely different units of goods, such as butter, hats, sugar, etc., and is therefore meaningless and illegitimate. Even pounds of sugar and pounds of butter cannot be added together, because they are two different goods and their valuation is completely different”. [4]

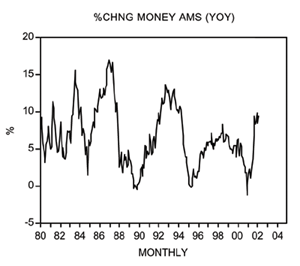

If changes in price indices cannot provide us with the status of inflation, what can? All that is required in establishing the status of inflation is to pay attention to the money supply’s rate of growth. The higher the rate of growth, the higher the rate of inflation.

Using the money supply definition of the Austrian School of economics, we can suggest that the rate of inflation in the U.S. is accelerating. The yearly rate of inflation jumped to 9.5 percent in February, from 0.1 percent in January last year. Moreover, between 1980 and 2001, the average rate of inflation stood at around 14 percent. Clearly, this shows that, rather than fighting inflation, the Fed has been the biggest promoter of inflation.

Conclusions

The U.S. government’s plan to introduce an improved Consumer Price Index in order to more accurately measure inflation is an exercise in futility. Inflation is not about a general increase in prices; it is about increases in the money supply. Hence, whatever the improved index would measure has nothing to do with true inflation, which is always increases in the money supply. Consequently, to find out the status of inflation, there is no need for various sophisticated price indices; all that is required is to pay attention to the money supply’s rate of growth.

Notes:

- [1] George Akerlof, William Dickens, George Perry, “Near Rational Wage and Price Setting and the Long Run Phillips Curve,” Brooking Institution study, 2000 ↩

- [2] Friedman, Thomas: Dollars and Deficits, Prentice Hall, 1968, pp. 47-48 ↩

- [3] Rothbard, Murray: America’s Great Depression, Mises Institute, 2001 [1963], p. 153) ↩

- [4] Rothbard, Murray: Man, Economy, and State, p. 734 ↩

Tags: Consumer Price Index, CPI, Inflation

רוצים להתקשר ל מאמן כושר אישי, מאמן כושר אישי, בא אליך 3 פעמים בשבוע. כדאי לפעילות גופנית, בונה לך תוכנית כושר אישית שמתאימה לך לאופי שלך

I am speechless. It is a superb blog and really attractive too. Nice paintings! That’s not in point of fact so much coming from an newbie publisher like me, however it’s all I may just say after diving into your posts. Nice grammar and vocabulary. No longer like different blogs. You truly know what you?re talking approximately too. Such a lot that you just made me want to discover more. Your weblog has change into a stepping stone for me, my friend.

I am really loving the theme/design of your website. Do you ever run into any web browser compatibility issues? A small number of my blog audience have complained about my website not working correctly in Explorer but looks great in Safari. Do you have any ideas to help fix this problem?

What a lovely day for a 3047745! SCK was here

Hello I am so delighted I found your blog, I really found you by mistake, while I was looking on yahoo for something else, Anyways I am here now and would just like to say cheers for a tremendous post and a all round entertaining blog. Please do keep up the great work.

Hi there, just became alert to your blog through Google, and found that it’s truly informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Please, can you PM me and tell me couple of much more thinks about this, Im truly fan of your websitegets solved properly asap.

This is getting a bit more subjective, but I much prefer the Zune Marketplace. The interface is colorful, has more flair, and some cool features like ‘Mixview’ that let you quickly see related albums, songs, or other users related to what you’re listening to. Clicking on one of those will center on that item, and another set of “neighbors” will come into view, allowing you to navigate around exploring by similar artists, songs, or users. Speaking of users, the Zune “Social” is also great fun, letting you find others with shared tastes and becoming friends with them. You then can listen to a playlist created based on an amalgamation of what all your friends are listening to, which is also enjoyable. Those concerned with privacy will be relieved to know you can prevent the public from seeing your personal listening habits if you so choose.

I admire the valuable info you offer in your posts. I will bookmark your blog for sure. keep it up!!

I was curious if you ever thought of changing the page layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

W.B. | Sep 16, 2010 | Reply

This site seems to recieve a good ammount of visitors. How do you promote it? It offers a nice individual spin on things. I guess having something authentic or substantial to say is the most important factor.

Any kind of homeowners certainly will choose to put in one of the best home security as a way to shield their property because of anti social factors. For this they could acquire regarding themselves the most effective home security model available in the market.

This page appears to recieve a good ammount of visitors. How do you advertise it? It offers a nice individual spin on things. I guess having something useful or substantial to post about is the most important factor.

9. We are a group of volunteers and opening a new scheme in our community. Your website provided us with valuable info to work on. You have done a formidable job and our whole community will be thankful to you.

Great article, mate. Just discovered your blog. Please keep up the good work!

I believe that may be a captivating element, it made me assume a bit. Thanks for sparking my thinking cap. Now and again I am getting so much in a rut that I just feel like a record.

Thanks for taking time for sharing this article, it was excellent and very informative. It?s my first time that I visit your blog. I found a lot of informative stuff in your article. Keep it up. Thanks a lot

קידום אתרים עושים רק בחברת קידום אתרים אמינה כמו חברת נט-סטייל . צרו עמנו קשר על מנת לרכוש שרות של קידום אתרים בגוגל בדרך הטובה ביותר.

You’re the best, beautiful blog with great informational content. This is a really interesting and informative content.

Thanks for having time for sharing this information, it was nice and very informative. It?s my first time that I visit your blog. I found a lot of good stuff in your article. Keep it up. Thanks a lot

Peculiar this publish is totaly unrelated to what I was looking google for, but it used to be indexed at the first page. I assume your doing one thing proper if Google likes you enough to position you at the first page of a non similar search.

Hey there, You’ve done an excellent job. I will certainly digg it and personally suggest to my friends. I’m confident they will be benefited from this website.

Odd this post is totaly unrelated to what I was searching google for, however it was indexed on the first page. I assume your doing something right if Google likes you sufficient to position you on the first web page of a non similar search.

Great post, mate. Just discovered your website. Please keep up the good work!

I came across your site, i think your blog is interesting, keep us posting.

Very interesting site, but you must improve your template graphics.

Good work, keep us posting, you are very good writer!!!

Very cool site, but you must improve your template graphics.

Very interesting website, but you must improve your template graphics.

Interesting post i totally agree with the comments above. Keep writing !!

Awsome post. Bookmarked for future referrence

Great article, mate. Just discovered your website. Please keep up the good work!

What a lovely day for a 312042! SCK was here

Pretty notable release. I just slipped up upon the blog and here desired to assert all the I’ve relished document your blog piece of content posts. However I’ll represent signing in the particular nurture and from now on I hope the client put out a few different times soon.

I made up solely trying this phenomenal information awhile. Right after 6 all day including continuous Googleing, in the end I got it in your blog . I enquire whats precisely the general shortage such as Google strategy the specific dont rank this original kinda illuminating blog articles in superlative of each and every leaning. Typically the best web sites are full like food waste .

Pretty notable put out . I just stumbled upon the blog and hoped to assert the specific I’ve appreciated brochures your blog doc posts. In any manner I’ll comprise signing in the reality feed and today I hope the client bring out 2 times soon.

I represented just seeking this excellent information for a while . Soon there after 6 non stop including continuous Googleing, in the end I got it in your blog . I enquire whats exactly the shortage for example Google routine your dont social status this amazing kind of informative blogs in top of each inclination . Usually the the best articles are full of food waste .